Deferred revenue expenditure is an intangible asset and appears under accounting standard 26. This post explains the same along with examples and the journal entry.

It is an expenditure which is incurred in the present accounting period but its benefits are incurred in the following or the future accounting periods. This expenditure might be written off in the same financial year or over a period of a few years.

What is deferred revenue expenditure?

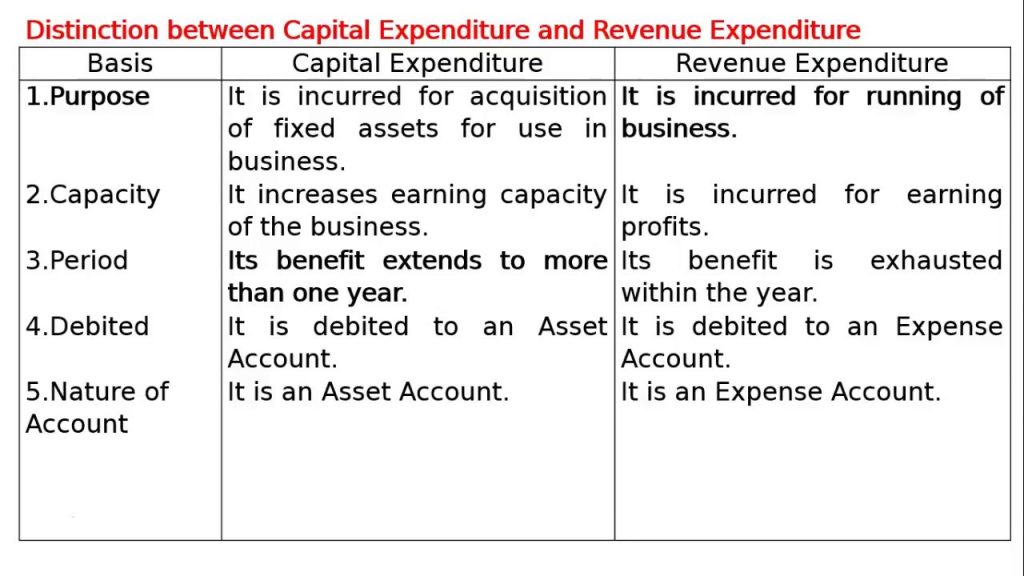

Capital expenditure leads to the purchase of an asset or which increases the earning capacity of the business. The organization derives benefit from such expenditure for a long-term. For example, the purchase of building, plant and machinery, furniture, copyrights, etc.

On the other hand, revenue expenditure is that from which the organization derives benefit only for a period of one year. It only helps in maintaining the earning capacity of the business. For example, the cost of raw materials, labour expenses, depreciation on assets, etc. However, there is also one more category of expenses, often referred to as Deferred Revenue Expenditure.

These expenses are revenue in nature but the business derives benefits from these expenses for more than one year. Though the benefit of these expenses lasts for a number of years, these do not fall under the Capital expenditure. Because these are heavy expenses but do not result in the acquisition of an asset. The charge of these expenses is proportionately deferred over the period for which its benefits are derived. Thus, this is as per the Matching Principle.

Examples

- Prepaid Expenses: The firm makes a substantial investment in certain activities like sales promotion activities. The benefits from this will be incurred over the number of accounting periods, but the expenditure is born in the same year. This expenditure will be written off over the number of periods.

- Exceptional Losses: Expenditure relating to exceptional losses by, for example, by an earthquake, floods, or unforeseen losses by loss or confiscation of property.

- Services Rendered: Since the expenditure for the services rendered cannot be allocated to one year only, and also there be no asset created with such expenditure—for example, the cost of research and development for the company.

- Fictitious Asset: Fictitious assets in cases, whose benefit is derived over a long period.

Classification

- Expenses partly paid in advance: It is when the firm derives a portion of the benefit in the current accounting year and will reap the balance in the future years. Thus, it shows the balance of the benefit that it will reap in future on the assets of the Balance Sheet. For example. advertising expenditure.

- Expenditure in respect of services rendered: Such expenditure is considered as an asset as it cannot be allocated to one accounting year. For example, discount on issue of debentures, the cost of research and experiments, etc.

- Amount relating to exceptional loss: We treat the exceptional losses also as deferred revenue expenditure. For eg. Loss by earthquake or flood, loss by confiscation of property, etc.

Features

- Expenditure is characterized by revenue and its features.

- The benefit of the expenditure is accrued for more than one year of an accounting period.

- The amount of expense is huge since its a one-time investment for the business and is therefore deferred over a period, which is more than one accounting period.

- These accrue over the future years, either partially or entirely.

Difference between capital expenditure and revenue expenditure

Deferred Revenue Expenditure in Balance Sheet

A deferred expenditure is placed on the balance sheet as an asset, since it is something that has been paid a certain amount for, but has not yet been used in its entirety. Some are considered current assets, if they are used fully within a year.

Example of a deferred expenditure:

- Your company purchases £4,000 of packing materials but only uses £1,000 within the month they were purchased

- By charging the full amount of £4,000 to your profit/loss account in that month, you would be distorting your figures

- The solution is to place the remaining amount on the balance sheet (in your records) as deferred expenditure and charge an appropriate amount the following month(s).

Also Read : Keeping Quiet Summary, Explanation Of Class 12 English

Accounting standard 26

This accounting standard relates to intangible assets. A recent clarification calls for deferred revenue expenses — like voluntary retirement scheme and preliminary expenses — to be written off at the time they are incurred as these do not fulfil the definition of an asset under the standard.

Journal Entry

Let’s say you own a candy shop. A customer pays you Rs. 180 for a 12-month candy subscription. You need to make a deferred revenue journal entry. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. And, you will credit your deferred revenue account because the amount of deferred revenue is increasing.

| Date | Account | Notes | Debit | Credit |

| 1/11 | Cash | Payment for candy subscription | 180.00 | |

| Deferred revenue | 180.00 |

Each month, one-twelfth of the deferred revenue will become earned revenue. In this case, Rs.15 per month will become revenue. You must make an adjusting entry to decrease (debit) your deferred revenue account and increase (credit) your revenue account.

| Date | Account | Notes | Debit | Credit |

| 1/11 | Deferred Revenue | One month of candy subscription | 15.00 | |

| Revenue | 15.00 |

Conclusion

Deferred revenue expenditure is an intangible asset and appears under accounting standard 26. This post has explained the same along with examples and the journal entry.