Objectives of Financial Management. Here you will learn about the different objectives of financial management.

Financial Management is the planning, organizing, directing and controlling the financial activities such as attainment and utilization of funds of a company. It means applying general management principles to the financial resources of the company.

Table of Contents

Objectives of Financial Management: Introduction

Financial Management is the area or function in a company which is concerned with profitability, expenses, cash and credit so that the company has a smooth running and also have the means to carry out its objective satisfactorily. Financial management provides pathways to attain goals and objectives in an organisation. Therefore, the finance manager is a very important position in a company.

Financial Management: Importance

Financial management helps to determine the financial requirement of the business concerned and leads to take financial planning in suitable ways. The financial planning is an important part of the business, which helps in the promotion of an organisation and smooth running of the organisation.

Objectives of Financial Management

The main objectives of financial management are given below:

1. Maximisation of Profit

Maximisation of Profit is one of the main objectives of financial management. Here the finance manager tries to earn maximum profit possible for the company in the short term and the long term.

- A company or any organisation can never guarantee profits because of long term business uncertainties.

- Meanwhile, the company can earn profits if the finance manager takes proper financial decisions and the finances of the company are used properly.

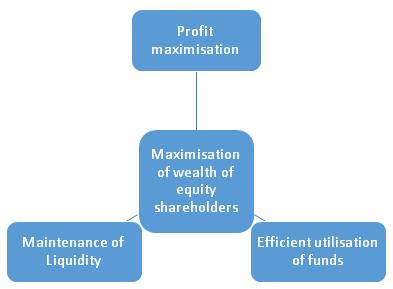

2. Maximisation of Wealth

The maximisation of wealth means that the organisation should maximise the shareholders’ assets. This is also the main objective of financial management.

- Likewise, earning maximum wealth for shareholders leads to building faith in the company. This helps in increasing the market value of the shares.

- The market value of shares is also directly related to the performance of the company. If the performance is good, the market value will increase and the reverse is true too.

- Thus the finance manager should try to maximise the shareholder’s value that is maximise the wealth.

3. Calculating the total financial demands

Estimating the total financial demands is very important from a financial management view. The finance manager should calculate the total financial demands of a company properly.

- He/She should find out how much finance is required to start or run the company.

- He/ She should find out the fixed capital and capital required to start and run the company smoothly.

- The calculation should be very accurate or else it might hinder the growth of the company.

- Calculation of finance depends on many factors, such as the type of technology used by the company, the number of employees employed, the scale of operations, legal requirements, etc.

4. Proper collection of finance

Proper arrangement of finance is a primary objective of financial management. The finance manager should be able to make proper and maximum utilisation of the finance.

- Profitable use of finance is a must.

- There should be zero or minimum wastage of the finance.

- The company should only use finance in profitable areas and avoid unprofitable situations.

5. Sustaining proper flow of money

Sustaining proper flow of money is one of the key objectives that directly improves the chances of survival and success of a company.

- A company must have a proper flow of money daily to purchase raw materials, payment of salaries, electricity bills, etc. to name a few.

- It should try to avail discounts on purchases, wholesale purchases, giving credit to customers, etc.

6. Decrease the value of capital

One of the objectives of financial management is to try to decrease the cost of the capital. That is, a company should try to borrow money at the lowest rate of interest.

Also Read : The Importance of Fundamental Rights

- The finance manager must plan the capital structure in such a way that the value of capital is minimised and the company can borrow money or take a loan at the lowest interest possible.

7. Decrease operating ventures

Financial management also should be focused on trying to reduce operating ventures. There are many risks and uncertainties in a business.

- The finance manager must take steps to reduce these ventures.

- Moreover, he/she must avoid high-risk projects at all costs.

- Proper insurance of the company should also be done.

8. Filing and Paying Taxes

The government is always around to collect taxes. Financial management must plan to pay its taxes on a timely basis. This paying of taxes is very crucial and influences a company’s reputation.

Objectives of Financial Management: FAQs

What are the main scopes and objectives of financial management?

These control the company’s reputation and the company’s success.

Define financial management.

What is the primary objective of financial management?

State one way to decrease operating ventures.

Why is filing and paying taxes important?

Objectives of Financial Management: Conclusion

Above all, financial management is an important skill for every business’ financial manager. Every decision that the company takes has a financial impact on it. Therefore the financial manager has to make these decisions within the total context of the company’s operations. Nowadays financial management is also popularly known as business finance or corporate finances. The business concern or corporate sectors cannot function without the importance of financial management.