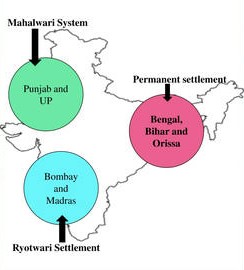

Three major systems of land revenue collection existed in India. They were – Zamindari, Ryotwari, and Mahalwari.

Thomas Munro introduced the Ryotwari System in 1820. It was introduced in areas of Madras, Bombay, parts of Assam, and Coorgh provinces of British India. In the Ryotwari System, the ownership rights were handed over to the peasants. British Government collected taxes directly from the peasants.

The new syllabus of GS Mains gives special mentions to ‘land reforms in India’. Hence, for UPSC, Ryotwari System in British India is a hot topic. This abstract will provide you with simple and quick notes on the Ryotwari System!

We also provide Notes and Lesson Plan. Our Study Rankers specially made them for better understanding. Students can practice concepts with NCERT Solutions and Extra Questions and Answers. (latest CBSE curriculum). Shine among your friends after scoring high in Quiz, MCQ, and Worksheet.

What is the Ryotwari System of Land Revenue?

Ryotwari system was one of the three principal methods of revenue collection in British India. It was common in most of southern India. It was the standard system of the Madras Presidency. Sir Thomas Munro devised this system at the end of the 18th century.

The name of the system comes from the word ryot, (an arabic word raʿīyah), meaning a peasant or cultivator.

The principle was the direct collection of the land revenue from each individual cultivator by government agents. For completing this purpose, The government gave the ownership rights to the peasants and the government collected the land revenue directly from the peasants. This model was based on English yeomen farmers.

The advantages of this system were the elimination of middlemen and an assessment of the tax. While the disadvantages included the cost of detailed measurement and individual collection and delivery of much power to revenue officials.

What was the Need to Introduce the Ryotwari System?

The Government was not satisfied by the revenues which were collected through the zamindari system which was introduced in 1793. Hence, the government opted for a system to directly collect the taxes from the farmers and recognize their ownership rights in return. By this, they got rid of the middlemen – zamindars. Let us understand this in detail:

- In permanent settlement areas, land tax was fixed hence, the government’s income did not increase.

- Interestingly, the middlemen zamindars pocketed the surplus.

- Zamindars were oppressive and led to revolts in the permanent settlement areas.

Also Read : NCERT Solution For Class 7 History Chapter 1 – THE DELHI SULTANS

- In the case of the Ryotwari System, there were no middlemen for tax collection.

- Therefore, the farmer has to pay fewer taxes.

Important Features

- The government claimed the property rights to all the land.

- Later, the government allotted it to the cultivators but on the condition that they pay taxes.

- Thus, they established a direct relation between the landholder and the government.

- Farmers could use, sell, mortgage, and lease the land but binding to the condition that they paid their taxes.

- Hence, the Ryotwari system gave an exclusive right to the landholders.

- If the farmers were unable to pay taxes, the government evicted them.

- Taxes were only fixed for a temporary settlement, which was a period of thirty years.

- The government had clutched the right to improve land revenue whenever they wanted to.

- Although the system provided measures for revenue relief during famines, they rarely applied them in real-life situations.

Effects of The Ryotwari System

Pros

- The Ryotwari System eliminated the middlemen, and hence they could no longer oppress the farmers.

- The government collected the tax directly from the peasants (ryots) or cultivators.

- The peasant was the owner of the land on which he performed cultivation.

- He could freely transfer, sell, or mortgage his property.

- The government could not expel the farmer from his estate as long as he cleared the taxation.

- It led to a reduction of assessments that the British government granted during unfavorable seasons.

- The charge was in money and it did not increase every year.

Cons

- The rate of taxation was quite high.

- The tax was not based on the actual revenues from the produce of the land.

- Instead, it was based on an evaluation of the potential of the soil.

- In some instances, the tax was more than 50% of the entire revenue.

- The farmers had to pay tax had only in cash. This exposed the cultivators to the orders of the moneylenders when crops failed.

Outcomes of the Ryotwari System

- Farmers had to pay revenue even during drought and famines, else he would be expelled from his land.

- Now, instead of a large number of zamindars, there was only one giant more powerful zamindar – The East India Company.

- Although the ryotwari system intended the direct collection of tax from farmers by the government, over the years, landlordism and tenancy grew extensive.

- Since the Government insisted on cash revenue, farmers resorted to growing cash crops instead of food crops. And cash crops needed more inputs which ultimately resulted in more loans and indebtedness.

- After the end of the American civil war, cotton export declined but the government didn’t reduce the revenue. And according to the system, the government expelled most of the farmers from their lands.

- The government transferred these lands from farmers to moneylenders.

- It led to the impoverishment of the farmers.

Differences Between Zamindari, Ryotwari and Mahalwari Systems of Land Revenue

| ZAMINDARI SYSTEM | RYOTWARI SYSTEM | MAHALWARI SYSTEM |

| Zamindari System was introduced by Cornwallis in 1793 through Permanent Settlement Act. | Ryotwari System was introduced by Thomas Munro in 1820. | Mahalwari system was introduced in 1833 during the period of William Bentick. |

| Also known as the Permanent Settlement System. | It was also known as Munro system. | In this system, the land was divided into Mahals. Each Mahal comprises one or more villages. |

| It was introduced in the provinces of Bengal, Bihar, Orissa, and Varanasi. | Major areas of introduction include Madras, Bombay, parts of Assam and Coorgh provinces of British India. | It was introduced in Central Province, North-West Frontier, Agra, Punjab, Gangetic Valley, etc of British India. |

| Zamindars were recognized as the owners of the lands. They were given the right to collect the revenue from the farmers. | In the Ryotwari System, the ownership rights were handed over to the peasants. British Government collected taxes directly from the peasants. | Ownership rights were vested with the peasants. |

| The earned amount would be divided into 11 parts: 1/11 of the share belongs to Zamindars and, 10/11 of the share belongs to The East India Company. | The revenue rates of the Ryotwari System were 50% where the lands were dry and 60% in irrigated land. | The villages committee was held responsible for collection of the taxes. |

Conclusion: The Ryotwari System

Sir Thomas Munro introduced the Ryotwari System in the Madras and Bombay presidencies between 1792 and 1827. The system removed the zamindars. The ryots paid the government about half the value of the crop.

This system gave more security to the ryots. But because of the rigidity of the revenue collection, farmers were impowered.

Browse StudyEquation for more scholarly articles like this!

… [Trackback]

[…] Read More here: studyequation.com/ryotwari-system-a-land-revenue-system-in-british-india/trackback/ […]